Skipping over prerequisites can leave you confused, while choosing a course too easy will waste your time and tuition dollars. With access to 1M+ customer reviews and the pros’ work history, you’ll have all the info you need to make a hire. See more reviews, compare prices, and hire your favorite pros all with Thumbtack. A minimum cumulative 2.00 grade point average (GPA) overall is required for graduation.

But we love that we can also go to them for project work related to budget planning, special analysis, and even help with staffing gaps. The entire team is very responsive, ready to roll up sleeves or spend time as thought Bookkeeping Oakland partners as we grow and scale. Partnering with a team of dependable, QuickBooks-certified accounting and bookkeeping experts can help you save time and stay focused on your goals, all while achieving consistent results.

Pham CPA & Associates

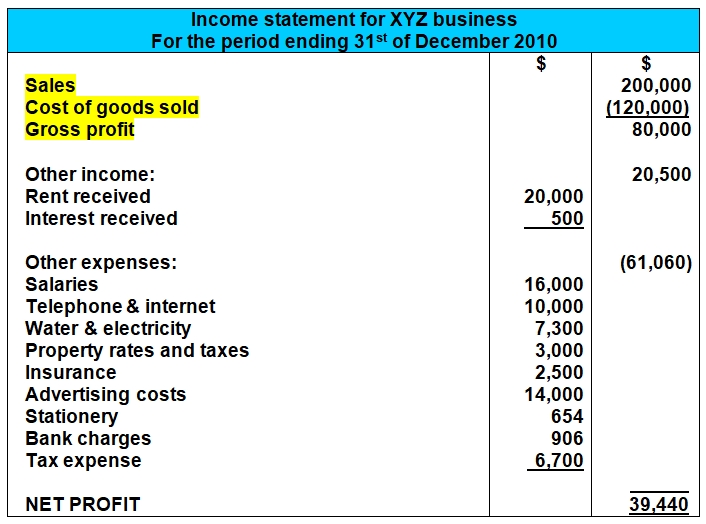

They handle a wide range of tasks, from invoicing, bill paying, bookkeeping, and financial reporting to budgeting. Every quarter, New Insight Accounting gives back to the community by donating a portion of its profits to good cause organizations. Accountants are financial professionals who have received an accounting degree from a four-year university or college. By trade, accountants prepare, maintain and examine the financial statements of an individual, business or institution. An accountant prepares reports for tax purposes and can also perform audits of public companies.

- The firm was recognized by the San Francisco Award Program as the best accounting firm in the SMB market in 2018.

- You can also ask an accountant to provide proof of their license and credentials.

- The entire team is very responsive, ready to roll up sleeves or spend time as thought partners as we grow and scale.

- Serving the community of Oakland and surrounding areas, it handles complex tax returns for individuals and businesses, bookkeeping, and payroll.

- Accountants may offer a package rate for weekly, monthly or annual services to reward ongoing customers.

- New Insight Accounting offers professional bookkeeping services for socially responsible businesses in Oakland.

Neither Classes Near Me (“CNM”) nor Noble Desktop is affiliated with any schools other than those listed on the Partners Page. The information provided on CNM for all schools is intended to provide information so that you may compare schools and determine which best suits your needs. The information provided is not updated regularly, so you should go to the schools website directly to verify their continued offerings.

Tameka’s Bookkeeping and Tax Consulting

Each one of these topics will directly enhance, supplement, or support your learning in Bookkeeping. To see how each topic relates to Bookkeeping and to focus your learning on any subcategory, see the subtopics section above. Live Online training is synchronous training where participants and the instructor attend remotely. Participants learn and interact with the instructor in real-time and can ask questions and receive feedback throughout the course. Instructors can remote into students’ computers (with prior permission) to assist with class exercises and any technical issues.

Accountants may offer a package rate for weekly, monthly or annual services to reward ongoing customers. Nationally, full-time staff accountants earn between $40,000 and $80,000, depending on experience and other factors. Any individual with a preparer tax identification number (PTIN) is eligible to https://accounting-services.net/accountant-salary/ file your income taxes on your behalf. However, this doesn’t necessarily mean they will be the best candidate to provide the help you need with your income tax preparation. The IRS explains that CPAs, attorneys and enrolled agents are all allowed to legally represent their clients before the IRS.

Torres Bookkeeping & Income Tax Services

Dorado Tax & Bookkeeping Services is an income tax and bookkeeping services provider in the Bay Area. The family-owned business started in 1954 founded by Tony H. Dorado, his son Jose A. Dorado currently operates the company’s Oakland office. Aside from its bookkeeping services, the company also provides community education and political literacy. Jose Dorado himself is also an enrolled agent for representing clients in front of the Internal Revenue Service. Dorado is also one of the only two offices in Oakland serving the Spanish-speaking community.

Contact local CPAs or tax professionals to see if they can offer their services without in-person contact. Many firms can operate remotely or virtually, and others that typically operate face-to-face may be changing their procedures to keep up with social distancing guidelines. If you know you need to get started in Bookkeeping but you’re not quite committed to learning it comprehensively, these courses will get you started with hands-on skills you can use right away. Many schools offer the ability to continue learning with intermediate-to-advanced courses, and some offer package discounts. For registration assistance and a list of partners and affiliate schools, see the Partners Page.

You can also ask an accountant to provide proof of their license and credentials. See the careers section for more information about the top related careers and the salaries in Oakland, and visit the career pages for detail on skill requirements, day-to-day work, compensation, tips, and more. Bookkeeping is an in-demand business skill that is essential for a variety of career paths. Here are some popular positions listing Bookkeeping as a skill and the average salaries in Oakland according to Indeed as of August 2020. To find the perfect fit for you, it’s important to determine what your training goals are.

- The company utilizes applications such as QuickBooks and ProSystems fx when managing accounts payables, accounts receivables, and electronic payments.

- According to the American Institute of CPAs, certified public accountant (CPAs) financially advise individuals, big companies and small businesses to help them reach their financial goals.

- The information provided on CNM for all schools is intended to provide information so that you may compare schools and determine which best suits your needs.

- Accountants do not automatically have a Certified Public Accountant (CPA) designation unless they have passed the Uniform CPA Examination and received the proper license.

- As a tax preparer I have seen first hand the high quality work that Streamline provides to its clients.

Once you have selected someone, ask about their service fees and confirm their availability. Then provide them with all the documentation they require, including W-2s, 1099s and more. Always ask to review the paperwork before it is submitted, and never sign a blank tax return. Torres Bookkeeping & Income Tax Services is a family-owned company that has been providing professional accounting and bookkeeping services for more than 30 years. Serving the community of Oakland and surrounding areas, it handles complex tax returns for individuals and businesses, bookkeeping, and payroll.

In Oakland, you’ll find a range of established businesses as well as rising start-ups seeking to make an impact. Forensic accountants investigate financial crimes involving fraud, embezzlement and other issues. They often work closely with law enforcement and lawyers, and they can help determine the legality of financial activities, according to the BLS.

- It offers quarterly, monthly, and annual record-keeping services to help businesses save time and focus on their work.

- CPAs are also eligible to represent clients before the IRS if audit support is required, while a non-CPA accountant is not.

- Always ask to review the paperwork before it is submitted, and never sign a blank tax return.

- See the careers section for more information about the top related careers and the salaries in Oakland, and visit the career pages for detail on skill requirements, day-to-day work, compensation, tips, and more.

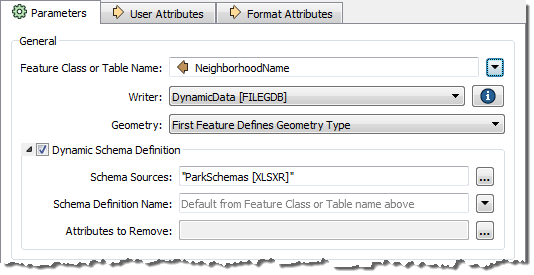

Accounting, Tax & Business Solutions (ATBS) supports the operations and growth of small- and medium-sized enterprises in Oakland by managing their books, configuring their software, and training their personnel. ATBS provides Accounting & Tax Services, Accounting System Setup, QuickBooks Training and Support. It evaluates the company’s current bookkeeping and accounting procedures and updates them to modern automated systems as necessary. He is a Certified Management Accountant and an Advanced QuickBooks ProAdvisor and Enterprise Solutions ProAdvisor. We rely on our Nonprofit Suite team for our specific reporting needs, month end close, 990 preparation and overall management of our audit process.